Australia’s IT sector is in the throes of an enormous spend-fest, according to official statistics, with capital expenditure recently hitting astonishing new records as the AI revolution sweeps Australia.

As the next chart shows, businesses under the category of ‘Information, media and telecommunications’ have seen capital expenditure soar to unprecedented heights.

And I will give you one guess what part of that category is driving the change.

Amazon just spent $93 billion on property and equipment in 12 months, up from $53 billion the year before, according to its most recent financial reports.

Meanwhile Microsoft is spending $15 billion each quarter on capex, up from $6 billion a quarter a few years earlier.

Alphabet, Microsoft, Amazon and Meta will spending $300 billion fuelling the AI fire this financial year, according to reports from Bloomberg.

Global spend on capex from major IT firms is a tidal wave and some of those ripples are hitting Australia.

Closer to home, ASX-listed data centre operator NextDC recently raised $680 million in capital which it is spending on expansion.

Spend, spend, spend

What is the money buying? The answer is partly software. Software counts as capital expenditure despite its ephemeral nature.

But we are also looking at hardware.

Imports of computer equipment recently hit record highs.

Semi-conductor imports peaked over 2022 and computer imports peaked in late 2024.

Interestingly, air conditioning imports also recently hit an unusually high level, hinting that data centre operators might be spending big money to keep their racks cool.

Australia’s data centres are in places that get stinking hot, including Microsoft’s new Kemp’s Creek centre. It reached 42 degrees there one day this past January.

The challenge for any importer of computer hardware in recent years is that chip prices have risen.

After many years of prices relentlessly falling, that process reversed around 2021.

The AI boom has been a windfall for chip makers, which is why chip maker NVIDIA is reporting gross margins of over 60 per cent and has seen its stock price rise nearly ten-fold since the start of 2023.

Rising prices for imports – as well as import volumes – explain why capex is rising in dollar terms.

What does the future hold?

The most recent data shows high capital expenditure, but not a record high.

AI hype has cooled a little. Rumours are of reduced investment in AI in the medium term.

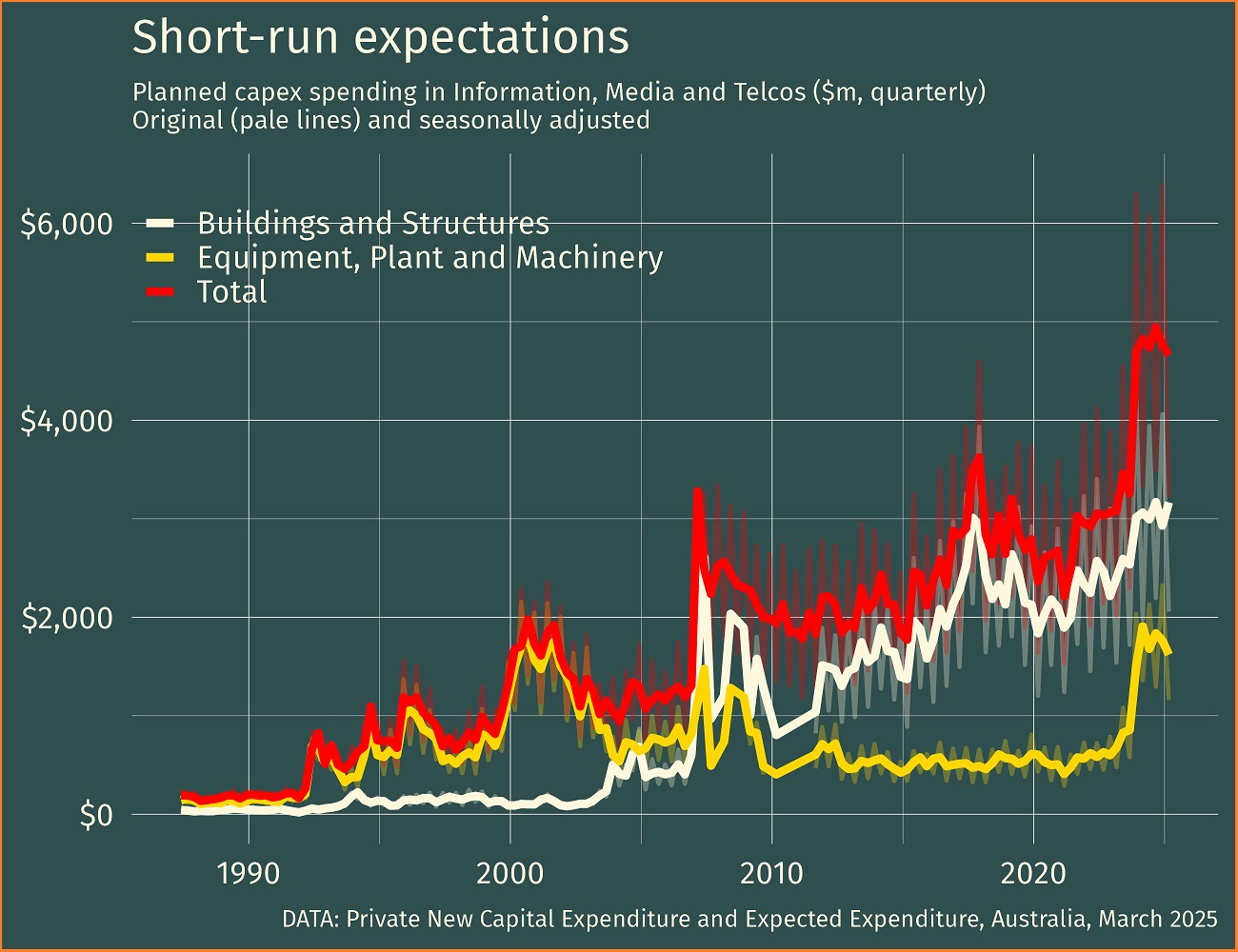

Has the peak passed? We have terrific data to answer that question for Australia because the ABS capex report also asks about planned capital expenditure in the short and long term.

The answer suggests any recent pullback is just a hiccup.

As the next chart shows, expectations for spending remain at very high levels.

If you haven’t cashed in on the AI boom so far, it seems like you don’t need to worry – there may be life in it yet.